Last Updated: 28 Oct 2025

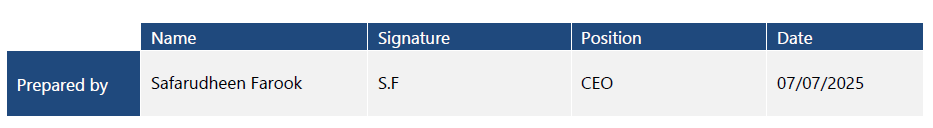

APPROVAL

The signatures below certify that this management system procedure has been reviewed and accepted and demonstrates that the signatories are aware of all the requirements contained herein and are committed to ensuring their provision.

AMENDMENT RECORD

This policy is reviewed to ensure its continuing relevance to the scope of organization and processes that it describes. A record of changes to this document is recorded below:

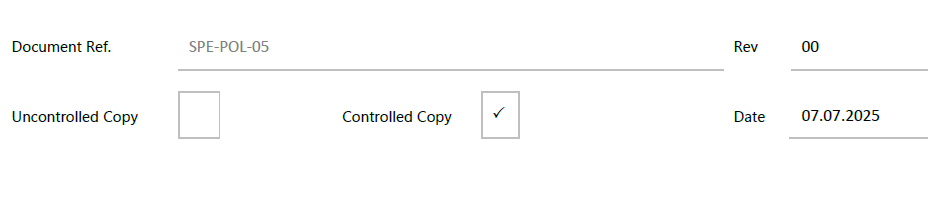

COMPANY PROPRIETARY INFORMATION

This document is the property of Tamanna; it contains information that is proprietary, confidential, or otherwise restricted from disclosure. If you are not an authorized recipient, please return this document to the above-named owner. Dissemination, distribution, copying or use of this document in whole or in part by anyone other than the intended recipient is strictly prohibited without prior written permission of Tamanna.

TABLE OF CONTENTS

1 INTRODUCTION

Tamanna BNPL COMPLAINT MANAGEMENT AND DISPUTE RESOLUTION PROCESS

2 COMPLAINT MANAGEMENT PROCESS

3 DISPUTE RESOLUTION PROCESS.

4 RECORD-KEEPING AND REPORTING

5 MONITORING AND CONTINUOUS IMPROVEMENT

1 Introduction

Tamanna BNPL Complaint Management and Dispute Resolution Process

This policy along with Term and condition & Customer Participation Consent Form together outlines the framework for managing complaints and resolving disputes arising from the use of Tamanna's Buy Now, Pay Later (BNPL) services by customers and merchants. The goal is to ensure a fair, transparent, and efficient process, adhering to regulatory standards and promoting customer and merchant satisfaction.recommendations for improving IT controls and governance.

2 Complaint Management Process

2.1. Purpose The purpose of the complaint management process is to provide a clear, structured approach for handling customer and merchant complaints, ensuring swift and fair resolution while maintaining high service standards.

2.2. Channels for Submitting Complaints Tamanna provides multiple channels through which customers and merchants can lodge complaints:

• Customer Support line: Available during business hours – ( +974 – 30520983).

• Email: Complaints can be sent to the dedicated email address Hello@spendwisor.com.

• Online Portal: A complaint submission form is available on the Tamanna website.

• In-Person: Customers or merchants can visit the Tamanna office to submit a complaint in person.

2.3. Steps for Handling Complaints

1. Acknowledgment:

•Complaints are acknowledged within 24 hours of receipt via email or phone.

• A unique case reference number is assigned for tracking purposes.

2. Initial Review:

• The complaint is reviewed by the customer support or merchant services team within1 business day.

• A preliminary assessment is made to determine whether it can be resolved immediately or needs further investigation.

3. Investigation:

•If further investigation is required, relevant teams (such as compliance, legal, or technical support) will be involved.

• Investigations should be completed within 7 to 10 business days.

4. Resolution:

•Once a resolution is identified, the customer or merchant will be informed of the outcome.

• If the complaint is resolved in favor of the complainant, corrective action (such as refunds, adjustments, etc.) will be taken within 3 business days after resolution.

5. Final Response:

• A formal written response is provided to the complainant, detailing the resolution and actions taken.

• If the complainant is unsatisfied with the outcome, they will be informed of their right to escalate the complaint (see Section 2.4).

2.4. Escalation Process

• If the complainant is dissatisfied with the resolution, they can escalate the matter to a higher authority within Tamanna by submitting an escalation request via email.

• The escalated complaint will be reviewed by the senior management or compliance officer within 5 business days.

• If the issue is still unresolved, the complainant has the option to seek external mediation through Qatar Financial Centre (QFC) or relevant regulatory authorities.Management is responsible for ensuring that IT controls are effectively implemented and maintained. They shall address any audit findings within their area of responsibility and report on the status of remediati

3 Dispute Resolution Process.

3.1. Purpose The dispute resolution process aims to provide customers and merchants with a clear procedure for resolving disputes that arise from BNPL transactions, such as billing errors, payment disputes, or service delivery issues.

3.2. Types of Disputes Covered

• Incorrect billing or overcharging for a BNPL transaction.

• Unauthorized transactions.

• Misunderstandings regarding repayment terms.

• Discrepancies in merchant services or goods delivery.

3.3. Dispute Resolution Procedure

1. Dispute Submission:

• Disputes must be submitted within 15 days of the transaction date.

• Customers or merchants can submit disputes through the same channels used for

complaints (see Section 2.2).

2. Acknowledgment:

• Disputes are acknowledged within 24 hours of receipt, and the customer/merchant is provided with a case reference number.

3. Review and Investigation:

• Tamanna’s dispute resolution team will review the details of the dispute and initiate an investigation within 3 to 5 business days.

• Relevant parties, including the customer, merchant, and payment processing teams, may be contacted for further information.

4. Provisional Resolution:

• During the investigation, a provisional action (such as holding disputed payments) may be taken to prevent financial loss to the complainant.

5. Final Decision:

• The investigation will conclude within 10 to 15 business days, and a decision will be communicated to both the customer and merchant.

•The final decision will outline whether the dispute is upheld or rejected, along with any corrective actions.

3.4. Appeals Process

• If either party is unsatisfied with the dispute resolution outcome, they have the right to appeal.

• Appeals must be submitted within 10 business days of receiving the decision, and they will be reviewed by senior management within 7 business days.

3.5. External Mediation

• If internal resolution efforts are unsuccessful, the dispute may be referred to external mediation.

• Tamanna will assist in escalating the dispute to the relevant regulatory body, such as Qatar Central Bank (QCB) or Qatar Financial Centre Authority (QFCA).The audit plan will be communicated to relevant stakeholders, including the IT Department and senior management. Any changes to the plan shall be documented and approved by the Audit Committee.

4 Record-Keeping and Reporting

4.1. Record Maintenance

• All complaints and disputes, along with their resolutions, will be documented and retained for a minimum of 5 years.

• Records will include communication logs, investigation reports, and final decisions.

4.2. Reporting to Regulatory Authorities

• Tamanna will periodically report complaint and dispute resolution statistics to relevant regulatory authorities, QCB.

• Serious disputes or complaints involving potential regulatory violations will be escalated to the authorities immediately. be thoroughly documented. The audit documentation should be clear, concise, and sufficient to

5 Monitoring and Continuous Improvement

• Tamanna’s compliance team will review the complaint and dispute resolution process annually.

• Feedback from customers and merchants will be used to improve services and update policies as needed.

Tamanna is committed to handling complaints and disputes in a timely, transparent, and fair manner. The company will continuously strive to ensure a positive customer and merchant experience by adhering to this policy framework.